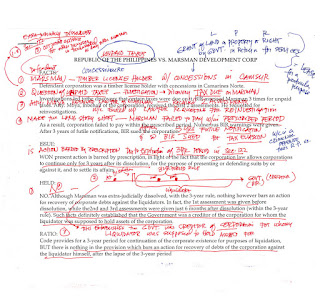

Defendant corporation was a timber license holder with concessions in Camarines Norte.

Investigations led to the discovery that certain taxes were due on it. BIR assessed Marsman 3 times for unpaid taxes. Atty. Moya, in behalf of the corporation, received the first 2 assessments. He requested for reinvestigation.

As a result, corporation failed to pay within the prescribed period. Numerous BIR warnings were given. After 3 years of futile notifications, BIR sued the corporation.

ISSUE:

WON present action is barred by prescription, in light of the fact that the corporation law allows corporations to continue only for 3 years after its dissolution, for the purpose of presenting or defending suits by or against it, and to settle its affairs.

WON present action is barred by prescription, in light of the fact that the corporation law allows corporations to continue only for 3 years after its dissolution, for the purpose of presenting or defending suits by or against it, and to settle its affairs.

RULING:

NO.

Although Marsman was extra-judicially dissolved, with the 3-year rule, nothing however bars an action for recovery of corporate debts against the liquidators. In fact, the 1st assessment was given before dissolution, while the 2nd and 3rd assessments were given just 6 months after dissolution (within the 3-year rule). Such facts definitely established that the Government was a creditor of the corporation for whom the liquidator was supposed to hold assets of the corporation.

NO.

Although Marsman was extra-judicially dissolved, with the 3-year rule, nothing however bars an action for recovery of corporate debts against the liquidators. In fact, the 1st assessment was given before dissolution, while the 2nd and 3rd assessments were given just 6 months after dissolution (within the 3-year rule). Such facts definitely established that the Government was a creditor of the corporation for whom the liquidator was supposed to hold assets of the corporation.

RATIO:

Code provides for a 3-year period for continuation of the corporate existence for purposes of liquidation, BUT there is nothing in the provision which bars an action for recovery of debts of the corporation against the liquidator himself, after the lapse of the 3-year period rule.

Code provides for a 3-year period for continuation of the corporate existence for purposes of liquidation, BUT there is nothing in the provision which bars an action for recovery of debts of the corporation against the liquidator himself, after the lapse of the 3-year period rule.